Australia 200 Index broke through important 6999.4199 price line

Australia 200 Index has broken through a resistance line. It has touched this line numerous times in the last 12 days. This breakout shows a potential move to 7100.3789 within the next 2 days. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

FTSE China A50 Index broke through important 13025.6104 price line

FTSE China A50 Index has broken through a support line. It has touched this line numerous times in the last 13 days. This breakout shows a potential move to 12833.9385 within the next 2 days. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

Australia 200 Index approaching resistance of a Channel Up

Australia 200 Index is approaching the resistance line of a Channel Up. It has touched this line numerous times in the last 9 days. If it tests this line again, it should do so in the next 2 days.

Will Hong Kong 50 Index have enough momentum to break resistance?

Hong Kong 50 Index is heading towards the resistance line of a Channel Up and could reach this point within the next 8 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout […]

Resistance line breached by Hong Kong 50 Index

Hong Kong 50 Index has broken through the resistance line which it has tested twice in the past. We have seen it retrace from this line before, so one should wait for confirmation of the breakout before trading. If this new trend persists, a target level of around 19927.0543 may materialize within the next 15 […]

Breach of important price line imminent by FTSE China A50 Index

FTSE China A50 Index is moving towards a line of 13068.1504 which it has tested numerous times in the past. We have seen it retrace from this position in the past, so at this stage it isn’t clear whether it will breach this price or rebound as it did before. If FTSE China A50 Index […]

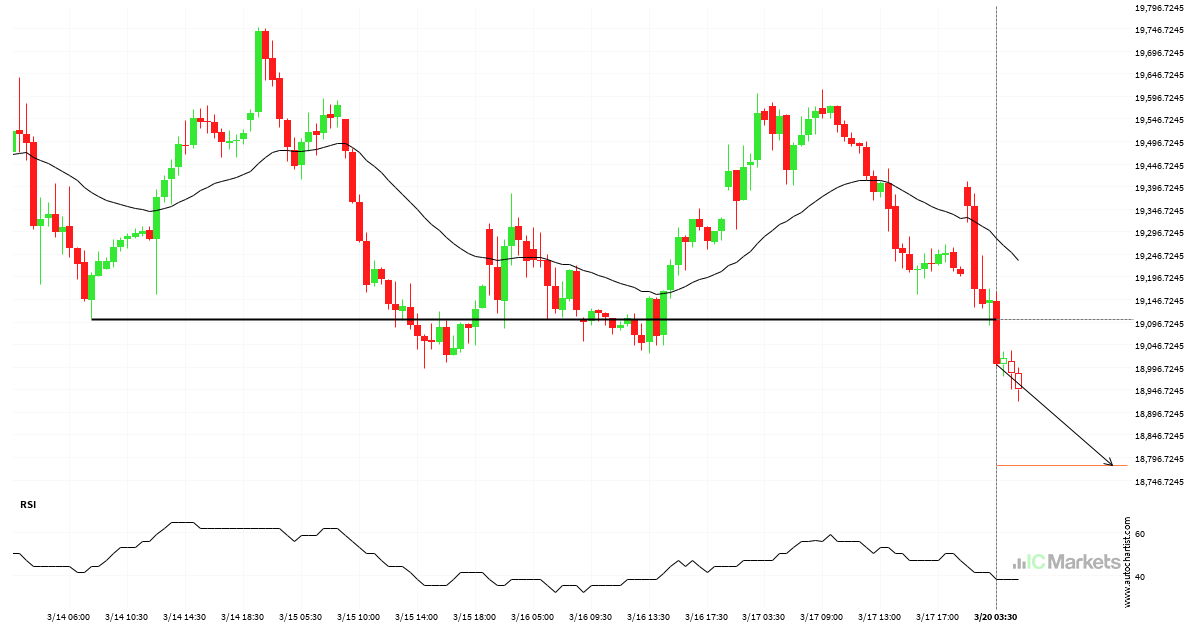

Hong Kong 50 Index broke through important 19102.4004 price line

Hong Kong 50 Index has broken through a support line. It has touched this line numerous times in the last 6 days. This breakout shows a potential move to 18779.8105 within the next 13 hours. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

FTSE China A50 Index has broken through resistance

FTSE China A50 Index has broken through a resistance line. It has touched this line at least twice in the last 16 days. This breakout may indicate a potential move to 13307.6301 within the next 3 days. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

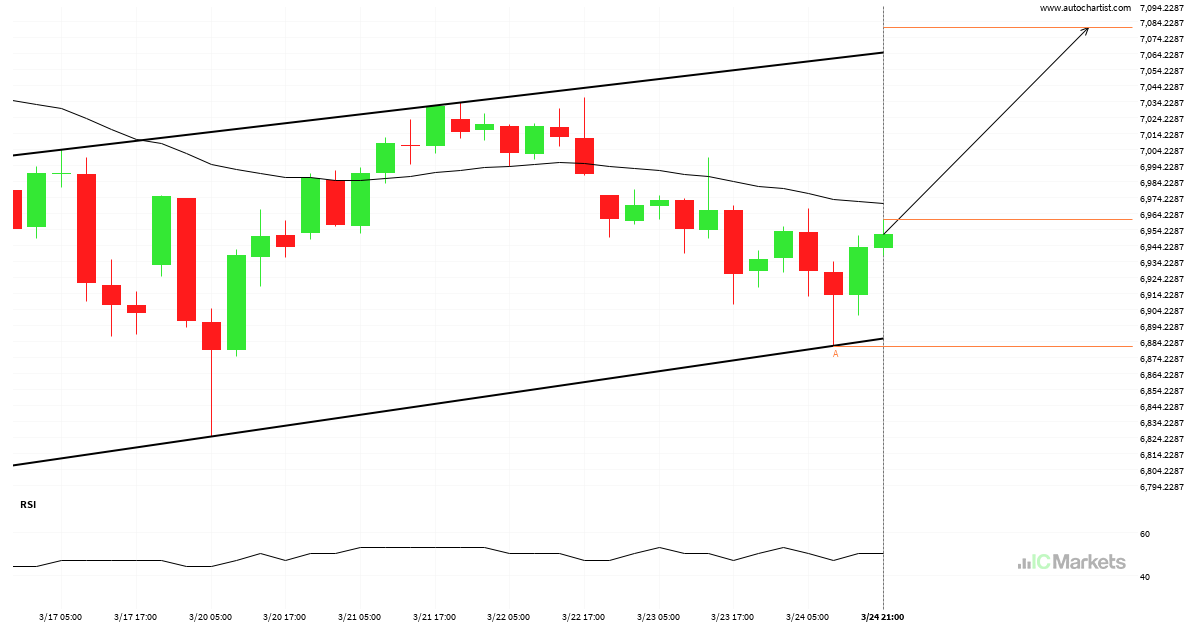

Resistance line breached by Australia 200 Index

Australia 200 Index has broken through the resistance line which it has tested twice in the past. We have seen it retrace from this line before, so one should wait for confirmation of the breakout before trading. If this new trend persists, a target level of around 7068.9900 may materialize within the next 2 days.

Will FTSE China A50 Index have enough momentum to break support?

FTSE China A50 Index is heading towards the support line of a Channel Down and could reach this point within the next 3 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout […]